Transaction Center

Time to bring it home. Find zipForm®, transaction tools, and all the closing resources you'll need. Except for the champagne — that's on you.

View the latest sales and price numbers. Find out where sales will be in upcoming months.

Watch our C.A.R. economists provide updates on the latest housing market data and happenings... quickly!

Get a roundup of weekly economic and market news that matters to real estate and your business.

Gain insights through interactive dashboards and downloadable infographic reports.

All Shareable Reports All Interactive DashboardsCatch up with the latest outreaches and webinars by the Research and Economics team.

C.A.R. conducts survey research with members and consumers on a regular basis to get a better understanding of the housing market and the real estate industry.

California Model MLS Rules, Issues Briefing Papers, and other articles and materials related to MLS policy.

Looking for information on how to file an interboard arbitration complaint? You've come to the right place! Find the rules, timeline and filing documents here.

Summaries and photos of California REALTORS® who violated the Code of Ethics and were disciplined with a fine, letter of reprimand, suspension, or expulsion.

The most recent edition of the Code of Ethics and Standards of Practice of the National Association of REALTORS® along with other important links to NAR information.

The California Professional Standards Reference Manual, Local Association Forms, NAR materials and other materials related to Code of Ethics enforcement and arbitration.

C.A.R. advocates for REALTOR® issues in Washington D.C., Sacramento and in city and county governments throughout California.

CREPAC, LCRC, IMPAC, ALF and the RAF comprise C.A.R.'s political fundraising arm.

REALTOR® Action FundLearn how you can make a difference, by getting involved yourself or by passing along valuable information to your clients.

Red Alert! Help C.A.R. STOP SB 679 (Kamlager)

Creates Agency with Broad Authority to Raise Taxes on Housing

C.A.R OPPOSES SB 679 (Kamlager) which creates an affordable housing finance agency in Los Angeles County. C.A.R. OPPOSES this bill because it grants vast, tax and bonding authority to a completely unnecessary appointed board that requires homeowners to subsidize corporate for-profit and government subsidized affordable housing development.

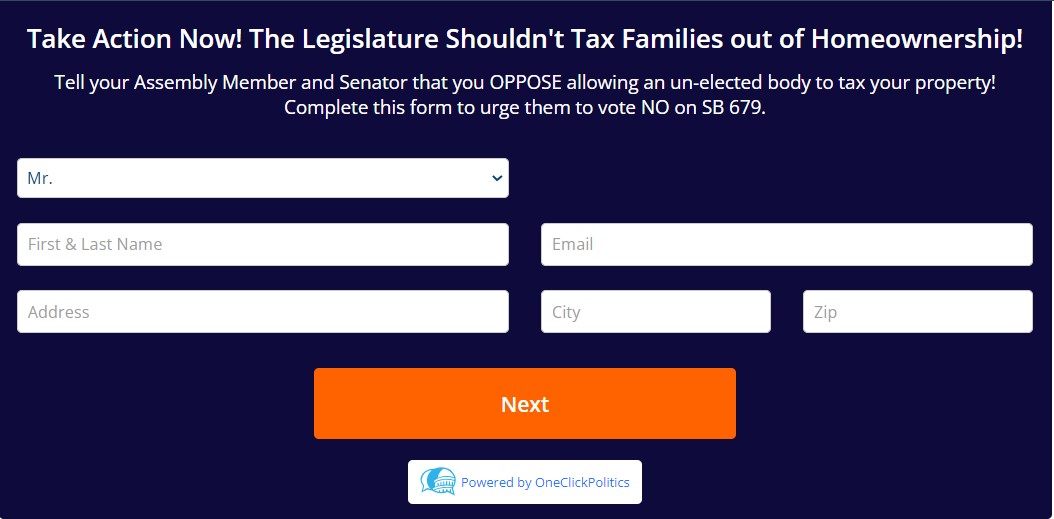

Take Action! Contact Your State Legislators TODAY to Oppose SB 679!

Background

SB 679 creates a finance agency to fund the construction of subsidized housing developments. The agency can also purchase existing residential properties, including single family homes further contributing to the shortage of homeownership opportunities.

SB 679 grants an unchecked tax and bond authority to a 21 member “governing board” that could authorize local ballot initiatives to impose: a parcel tax, gross receipt tax, documentary transfer tax or authorize the issuance of bonds. Any of those taxes or costs on their own would create new burdens for homeowners struggling in a tough economic environment. Furthermore, the bill has no cap on the maximum amount homeowners can be taxed and these taxes could be layered on top of each other.

SB 679 is completely unnecessary and duplicative. There is no need for a costly new bureaucracy to do things that can already be undertaken by Los Angeles County in conjunction with its cities.

Take Action! Contact Your State Legislators TODAY to Oppose SB 679!

Why C.A.R. is OPPOSING SB 679:

For More Information

For additional information contact C.A.R. at [email protected].